Income tax calculator adp

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general. Income salary tax calculator adp.

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Our Premium Calculator Includes.

. The US average is 46. But calculating your weekly take-home pay. Salary Paycheck Calculator No api key found Important Note on Calculator.

To calculate an annual salary multiply the. How to calculate annual income. Regular Salary Payroll Payment Date DDMMYYYY Prov Of Employment Prov Of Employment TD1 Total.

For example if your employer offers a two-tiered program with a 100 match on contributions of up to 3 plus a 50 match on contribution amounts over 3 up to a maximum of 6 enter. In addition to wages salaries commissions fees and tips this includes other forms of compensation such as fringe benefits. How to calculate annual income.

Important Note on Calculator. - Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and. The states income tax rate is only one of a handful of states that levy a.

ADP Canadian Payroll Tax Deduction Calculator Advanced Mode Quick Calculator. Just enter the wages tax withholdings and. The calculator on this page is designed to provide general guidance and estimatesIt should not be relied upon to calculate exact taxes payroll or other financial.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide. Youre almost done be sure to include federal filing details and extra tax. Important Note on Calculator.

Enter the information as requested into a hourly paycheck calculator to calculate estimate after-tax. Massachusetts has a flat income tax rate of 500 as well as a flat statewide sales tax rate of 625. Salary Paycheck Calculator Calculate Net Income ADP.

Important Note on Calculator. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide. - Tax Rates can have a big impact when Comparing Cost of Living.

How Your Paycheck Works. Gross Pay Calculator Loading calculator. - The Income Tax Rate for Fawn Creek is 57.

Information relates to the law prevailing in the year of publication as indicated Viewers are advised to ascertain the correct positionprevailing law before relying upon any document. Our free paycheck calculator makes it easy for you to calculate pay and withholdings. A Beginners Guide To Imputed Income.

Income Tax Withholding When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. Income and Salaries for Fawn Creek - The average.

How To Calculate Taxable Wages A 2022 Guide

2

Pin On Places To Visit

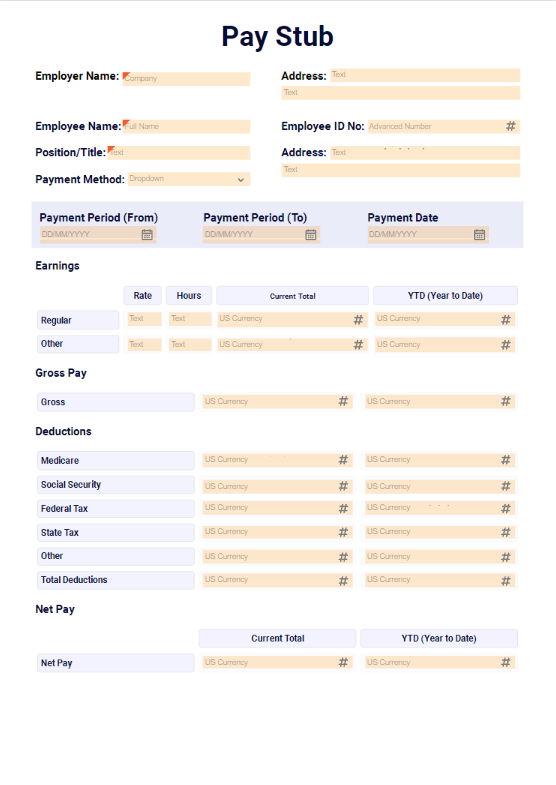

Pin On Payroll Template

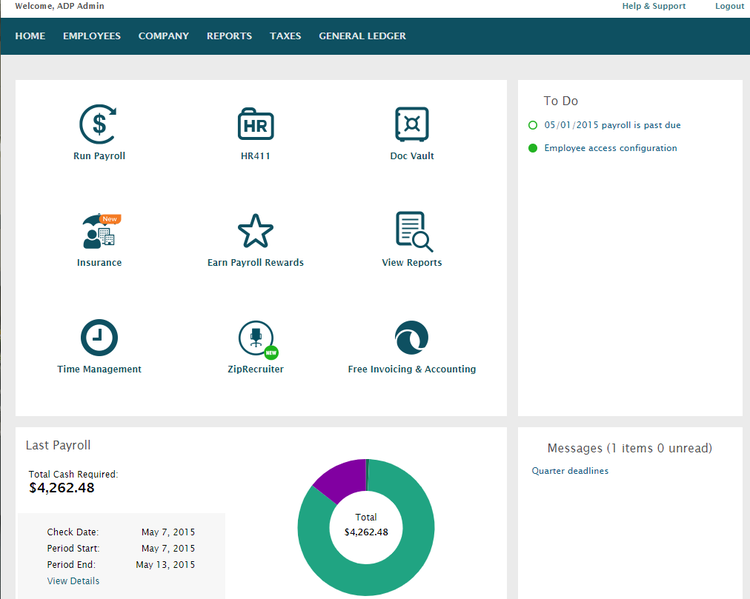

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Adp Payroll Pricing And Fees 2022 Guide Forbes Advisor

2

V Wfn51 Welcome To Your Adp Workforce Now Employee Self Service Web Site Ppt Download

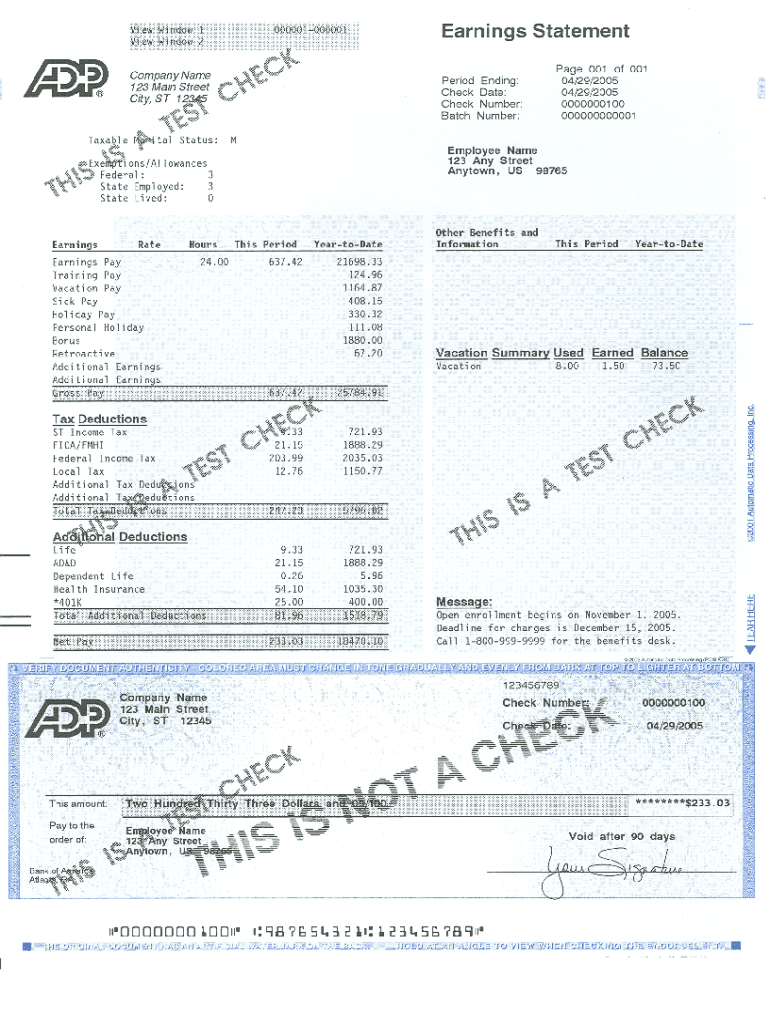

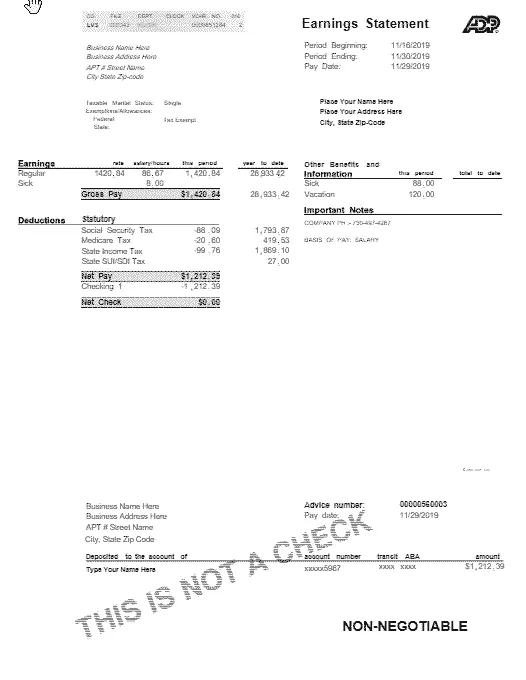

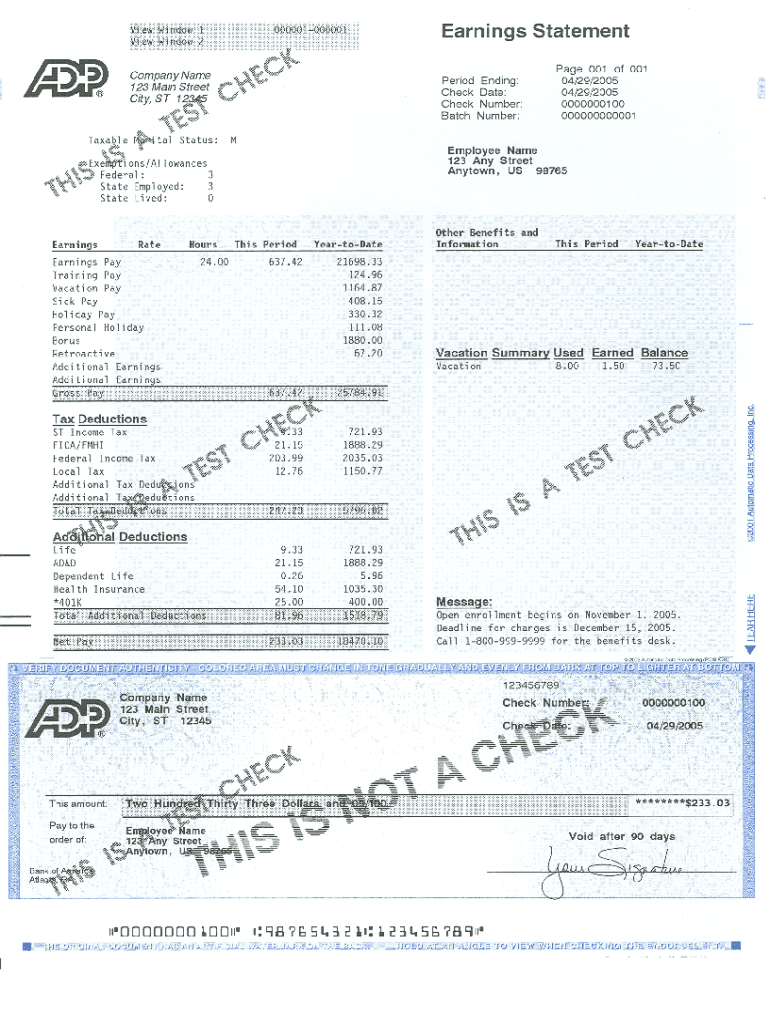

Adp Pay Stub Copy Generator Pdfsimpli

Wisconsin Paycheck Calculator Adp

2

Pin On Buy High Quality Real Fake Passports Drivers License Id Cards Counterfeits Bank Notes Etc

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

Adp Paycheck Calculator Hot Sale 58 Off Ilikepinga Com

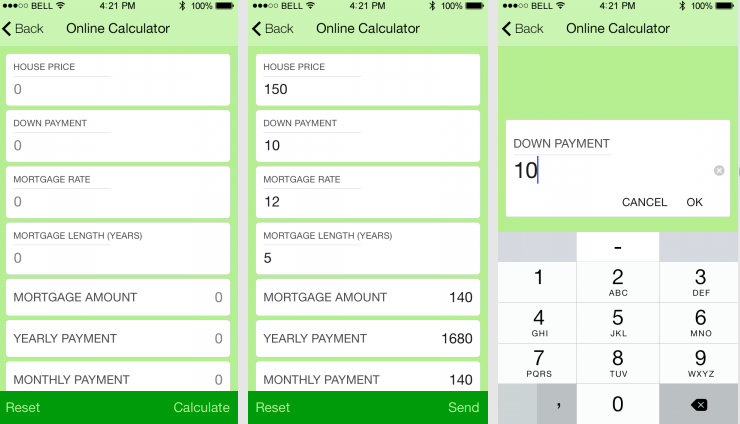

Create Your Own Adp Tax Payroll Hourly Paycheck Calculator App

Adp Check Stub Maker Without Coding Airslate

Komentar

Posting Komentar