Home mortgage interest deduction calculator

Mortgage Tax Savings Calculator. Use the mortgage tax savings calculator to determine how much your mortgage payments could reduce your income taxes.

Publication 936 Home Mortgage Interest Deduction Part Ii Limits On Home Mortgage Interest Deduction

You can use this as a tool to guide your estimates.

. However higher limitations 1 million 500000. Estimate Your Monthly Payment Today. Matt is a Certified Financial Planner based in South Carolina who has been writing for The Motley Fool.

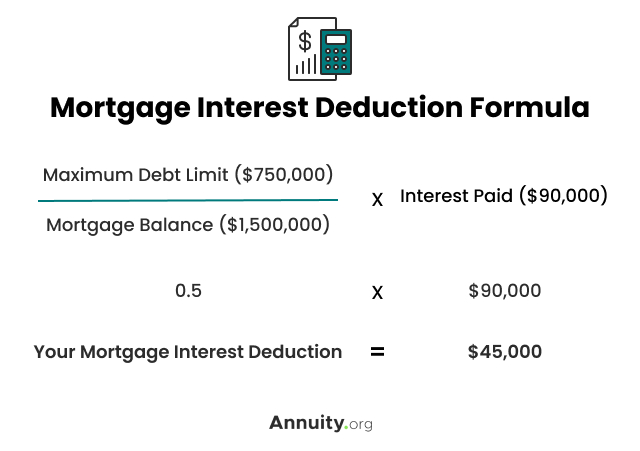

Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. The calculator can also estimate other costs associated with homeownership giving the borrower a more accurate financial picture of the costs associated with owning a home. You can claim a tax deduction for the interest on the first 750000 of your.

Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today. Use our Mortgage Tax Deduction Calculator to determine your mortgage tax benefit based on your loan amount interest rate and tax bracket. Ad More Veterans Than Ever are Buying with 0 Down.

Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. Under the new tax plan which takes effect for the 2018 tax year on new mortgages you may deduct the interest you pay on mortgage debt up to 750000 on your. The interest paid on a mortgage along.

The interest paid on a. However higher limitations 1 million. 1 The Tax Cuts.

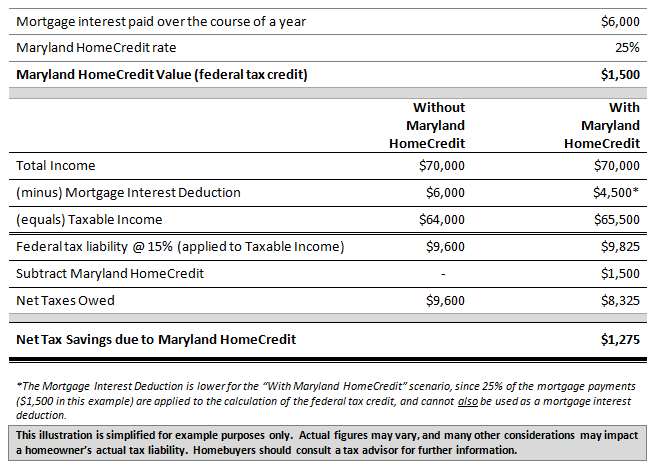

The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. A mortgage calculator can help you to see just how much you will be able to deduct from your loan though. How much can the mortgage tax credit give you tax savings.

For taxpayers who use married filing separate. Interest On Your Mortgage. Example Your clients want to.

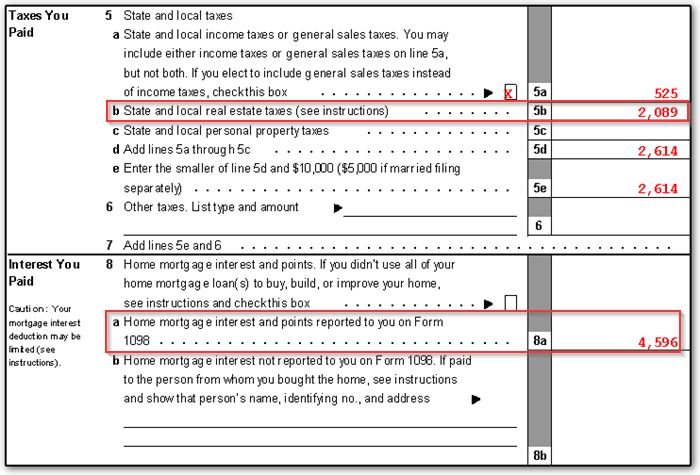

You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Deductible Home Mortgage Interest Calculator This calculator computes your clients qualified mortgage loan limit and the deductible home mortgage interest. Please note that if your mortgage closed on or.

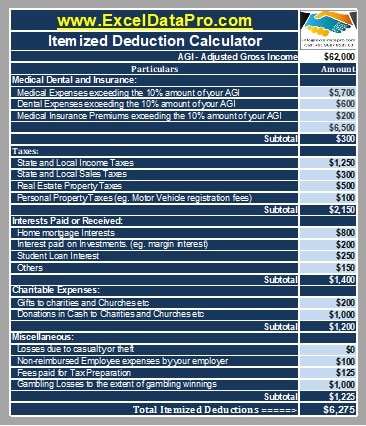

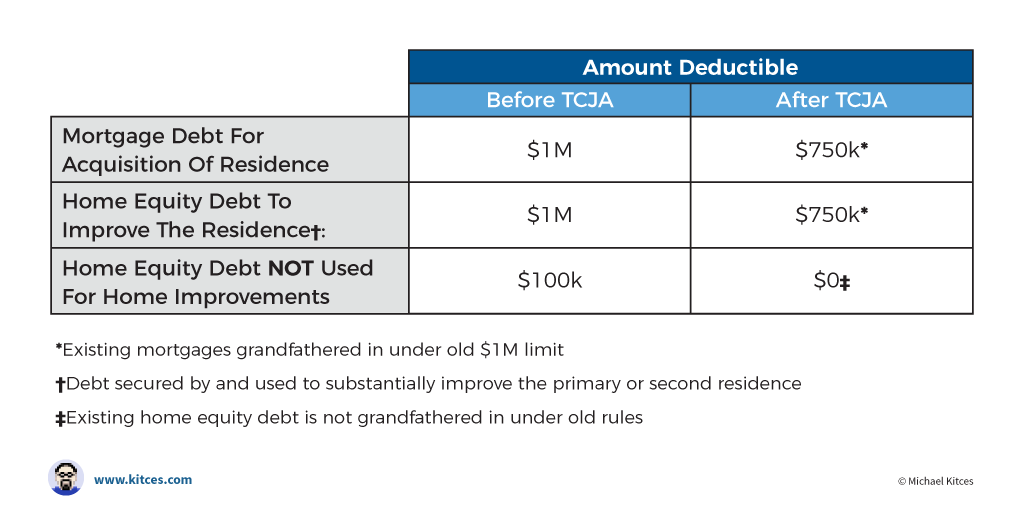

You itemize the following deductions as a single individual. Mortgage interest 6000 student loan interest 1000 and charitable donations 1200. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000.

This Mortgage Tax Deduction Calculator Shows a Big Benefit of Homeownership. 100 Accurate Calculations Guaranteed. Ad Try Our Free And Simple Tax Refund Calculator.

Trusted VA Home Loan Lender of 300000 Military Homebuyers. Use the mortgage tax savings calculator to determine how much your mortgage payments could reduce your income taxes. You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebt- edness.

The home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of their loan principal. A mortgage calculator can help you determine how much interest you paid each month last year. Find out with our online calculator.

Download Itemized Deductions Calculator Excel Template Exceldatapro

Download Itemized Deductions Calculator Excel Template Exceldatapro

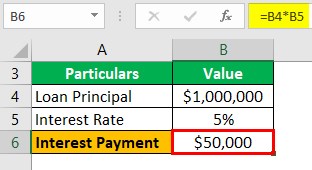

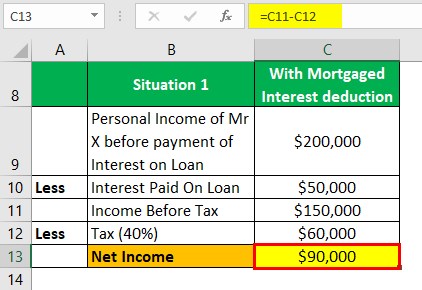

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Tax Deduction What Is It How Is It Used

Mortgage Tax Deduction Calculator Freeandclear

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

Mortgage Interest Deduction How It Calculate Tax Savings

Free Mortgage Calculator Mn The Ultimate Selection Mortgage Interest Tax Deductions Mortgage Interest Rates

1040 Schedule E Tax Court Method Election

Mortgage Tax Deduction Calculator Homesite Mortgage

The Best Home Office Deduction Worksheet For Excel Free Template

Maryland Homecredit Program Lender Information

Free Home Office Deduction Worksheet Excel For Taxes

Home Ownership Expense Calculator What Can You Afford

Is Home Equity Interest Deductible For New York State My Turbotax Return Shows A 0 For It 196 Line 10 Even Though I Paid 2513 In Interest On My Loc Balance 45000

Tax Deductions For Home Mortgage Interest Under Tcja

Komentar

Posting Komentar